Think of ASC 606 revenue recognition as the Beyoncé of accounting standards—powerful, influential, and here to stay. While the concept might seem intimidating at first, understanding its principles is crucial for businesses of all sizes. This guide will break down the essentials of ASC 606 revenue recognition, providing you with the knowledge and tools to navigate its complexities and ensure your business stays ahead of the curve.

Key Takeaways

- ASC 606 impacts how you recognize revenue: This standard provides a consistent framework for recognizing revenue, impacting financial reporting across all industries. Make sure you understand the core principle of "transfer of control" and how it applies to your business.

- Implementation requires a strategic approach: Take a close look at your contracts, update your accounting systems, and train your team on the new guidelines. Remember, clear documentation is key to a smooth audit process.

- Technology can simplify compliance: Consider using software solutions to automate your revenue recognition process, improve data accuracy, and gain real-time insights into your financial performance.

What is ASC 606?

ASC 606 is a revenue recognition standard that impacts any business that sells products or services to customers. It creates a standardized framework for recognizing revenue, which helps ensure consistency and comparability across different industries.

Think of it this way: ASC 606 lays out the rules for how and when businesses should record their revenue. This is a big deal because it directly impacts a company's financial statements, making sure they're accurate and transparent.

Before ASC 606, different industries often had their own interpretations of revenue recognition, which could make it tricky to compare financial performance across companies. ASC 606 aims to level the playing field by providing a single set of guidelines everyone can follow.

ASC 606 Revenue Recognition: A Five-Step Guide

This five-step guide breaks down the key components of ASC 606, making it easier to understand and apply to your business.

Step 1: Identify the Contract

First things first: you need a contract. This is any agreement between your business and a customer that creates legally enforceable rights and obligations. It's the foundation for recognizing revenue.

Step 2: Identify Performance Obligations

Next, pinpoint exactly what you've promised to deliver to your customer. These are your performance obligations, which could be anything from providing a tangible product to delivering a service. Each distinct obligation needs to be accounted for separately.

Step 3: Determine the Transaction Price

This step involves figuring out how much your customer will pay in exchange for those goods or services. Sounds simple, right? But it can get tricky with things like variable consideration (think discounts or bonuses). Accurately estimating the transaction price is crucial for proper revenue recognition.

Step 4: Allocate the Transaction Price

Now that you know the total price, you need to divide it fairly among each performance obligation. This allocation should be based on the relative standalone selling prices of each item or service.

Step 5: Recognize Revenue

Finally, the good part! You can recognize revenue when (and only when) you've satisfied a performance obligation. This typically happens when control of the good or service is transferred to the customer.

ASC 606: Key Principles and Requirements

This new standard seeks to standardize how companies across industries report their revenue. Let's break down some of the key principles and requirements.

Core Principle: Transfer of Control

The heart of ASC 606 is the idea of "transfer of control." Simply put, this means a company recognizes revenue when it delivers goods or services to a customer, and the customer takes ownership. This represents a shift from previous standards that often focused on when revenue was "earned." Deloitte's guide to ASC 606 provides a helpful deep dive into this concept.

Consistency Across Industries

Before ASC 606, different industries often had unique ways of recognizing revenue, making it difficult to compare the financial performance of companies in different sectors. ASC 606 aims to level the playing field by establishing a single framework for revenue recognition that applies to all companies, regardless of industry. As Stripe explains in their ASC 606 guide, this standard impacts pricing and customer contracts for private and public businesses alike.

Enhanced Disclosure Requirements

ASC 606 doesn't just change when companies recognize revenue; it also changes how they disclose that revenue to investors and the public. Companies now provide more detailed disclosures about their revenue recognition policies, including information about the judgments and estimates they made in applying ASC 606. These enhanced disclosures give investors a clearer picture of a company's financial performance. Certinia's overview of ASC 606 offers a helpful breakdown of these requirements.

Overcoming ASC 606 Implementation Challenges

Let’s be real: getting your business aligned with ASC 606 can feel like a heavy lift. But don’t worry, we’re here to break down these challenges into manageable steps.

Process and System Changes

Thinking about new accounting standards often brings up questions about updating your processes and systems. And you’re right to think about this! Implementing ASC 606 often requires companies to take a hard look at their current processes and identify any gaps. This could involve anything from revisiting how your team reviews contracts to how you collect and manage data. The good news is that by identifying these needs early on, you can create a plan to address them efficiently.

Review and Analyze Contracts

Remember to take a close look at your contracts. Why? Because under ASC 606, you need to pinpoint the individual performance obligations within each one. This step is crucial because it directly impacts how you recognize revenue. Don’t be surprised if you need to revisit your contract templates or introduce new clauses to capture the necessary information.

Estimate Variable Consideration

Ever had a contract where the final price wasn’t set in stone? Think discounts, rebates, or performance bonuses. ASC 606 wants you to get a handle on this “variable consideration” upfront. You’ll need to estimate this amount as accurately as possible at the start of the contract, which can be tricky. The goal is to make sure you’re not recognizing revenue too early or too late.

Manage and Collect Data

You’re going to need accurate data to support your revenue recognition process under ASC 606. This means you might need to level up your data management game. Think about how you’re currently capturing information about your contracts, performance obligations, and variable considerations. Are there any gaps in your data collection process? Do you have systems in place to ensure accuracy and completeness? Addressing these questions head-on will make your ASC 606 journey much smoother.

Achieving ASC 606 Compliance: Strategies

Successfully navigating the intricacies of ASC 606 requires a strategic and proactive approach. Here are four key strategies to help your business achieve and maintain compliance:

Implement Comprehensive Staff Training

Thorough staff training is the cornerstone of successful ASC 606 implementation. Your team needs to understand the standard's core principles, the five-step revenue recognition model, and its practical implications for your industry. Consider these training focal points:

- Key ASC 606 Principles: Ensure your team clearly understands the fundamental concepts of the standard, including the shift to a control-based revenue recognition model.

- Five-Step Revenue Recognition Model: Provide a detailed walkthrough of each step, emphasizing practical application and potential challenges.

- Industry-Specific Considerations: Address the unique aspects of ASC 606 relevant to your industry, drawing on real-world examples and case studies.

Investing in ongoing training programs ensures your accounting and finance teams stay current on evolving standards and best practices. For helpful resources and insights to guide your team's understanding of ASC 606, check out the HubiFi blog.

Establish Robust Accounting Systems and Internal Controls

Reliable accounting systems and robust internal controls are non-negotiable for ASC 606 compliance. Think about these action items:

- System Evaluation: Assess your current accounting systems to determine their ability to accommodate the data capture and reporting requirements of ASC 606.

- Process Automation: Explore automation solutions to streamline revenue recognition processes, minimize manual intervention, and reduce the risk of errors.

- Internal Control Enhancement: Strengthen internal controls related to contract review, revenue recognition, and data management to ensure compliance and prevent revenue leakage. A KPMG report emphasizes the importance of addressing internal controls during ASC 606 implementation.

Review Policies and Documentation Regularly

Maintaining up-to-date policies and meticulous documentation is crucial for a smooth audit process and ongoing compliance. Focus on these areas:

- Policy Alignment: Review and update your revenue recognition policies to align with ASC 606 guidelines. Clearly document these policies and communicate them effectively across your organization.

- Contract Review Process: Establish a standardized process for reviewing and documenting contracts, ensuring all relevant revenue recognition criteria are identified and addressed.

- Judgment and Estimate Documentation: Maintain detailed records of all judgments and estimates made during the revenue recognition process. This documentation provides an audit trail and supports the transparency of your financial reporting. For insights into best practices and lessons learned from ASC 606 implementation, take a look at the resources from the AICPA.

Monitor and Assess Continuously

ASC 606 compliance is an ongoing process, not a one-time project. Continuous monitoring and assessment are essential for identifying and addressing potential issues proactively. Consider these practices:

- Performance Tracking: Establish key performance indicators (KPIs) to track the effectiveness of your ASC 606 implementation. Regularly review these metrics to identify areas for improvement.

- Process Refinement: Conduct periodic reviews of your revenue recognition processes, seeking feedback from stakeholders and making necessary adjustments to optimize efficiency and accuracy.

- Stay Informed: Keep abreast of any updates, interpretations, or emerging guidance related to ASC 606 to ensure your practices remain compliant. Financial Executives International highlights the importance of continuous monitoring and learning from industry leaders.

ASC 606: Impact on Financial Reporting

This new standard significantly impacts how businesses report their financials. Let's take a look.

Changes in Revenue Recognition Timing

ASC 606 moves away from older revenue recognition models and instead focuses on when control of a good or service is transferred to the customer. This can shift when revenue is recognized on your financial statements. For example, instead of recognizing revenue upfront for a multi-year contract, you might recognize it over the contract duration as you deliver the services.

Effects on Key Financial Metrics

This change in revenue recognition timing can significantly impact key financial metrics like revenue growth, profitability, and cash flow. It's essential to understand how these changes might influence your financial reporting and analysis. For a deeper look at how HubiFi can help you manage these changes, check out our integrations with popular accounting software.

Avoid These Common ASC 606 Implementation Pitfalls

Let's be real, implementing a new accounting standard like ASC 606 can feel like navigating a maze, especially for high-volume businesses. Missteps happen, but understanding common pitfalls can save you a lot of headaches down the line.

Inadequate Contract Review

Think of your contracts as the foundation of your revenue recognition process. You absolutely need to know what you're dealing with. A thorough contract review is non-negotiable. This means carefully examining each contract to identify all the separate performance obligations. Remember, a single contract can involve multiple performance obligations, each with its own revenue recognition timeline.

Improper Treatment of Variable Consideration

Variable consideration is that "it depends" factor in pricing – think discounts, rebates, or performance bonuses. ASC 606 requires you to factor in this variable consideration when determining the transaction price. Getting this wrong can significantly impact your revenue numbers.

Insufficient Documentation

Don't skimp on the paperwork! I know, I know, it's not the most glamorous part of the job, but proper documentation is crucial for supporting your revenue recognition decisions. Think of it as creating a clear audit trail. When auditors come knocking (and they will), you'll be ready.

Overlooking Management Judgment

ASC 606 isn't just about plugging numbers into a formula. It requires sound management judgment, especially when determining the transaction price and assessing those performance obligations. Make sure your team understands the why behind the numbers and feels empowered to make informed decisions.

ASC 606 Considerations: Industry Specifics

While ASC 606 provides a standardized framework, its application varies across industries due to different business models and contract structures. Let's explore how specific industries navigate ASC 606:

Software and Technology

Software and technology companies often grapple with complex performance obligations. Think software licenses, implementation services, and ongoing support. IncentX points out that ASC 606 requires these companies to clearly distinguish between performance obligations satisfied at a point in time versus over time, directly impacting when they can recognize revenue.

Telecommunications

Telecom companies face unique challenges due to contracts with variable considerations like discounts and free installation. BDO emphasizes the importance of accurately estimating these variables to comply with ASC 606 and avoid potential revenue reversals.

Construction and Real Estate

The long-term nature of construction and real estate contracts requires a revenue recognition approach that reflects performance over time. Financial Executives International highlights the need for these companies to diligently track and measure progress toward contract completion to ensure accurate revenue recognition.

Healthcare

Healthcare organizations navigate intricate contracts involving bundled payments and performance-based incentives. The Journal of Accountancy stresses the importance of carefully evaluating these contracts to identify separate performance obligations and apply appropriate revenue recognition methods.

Retail

Retailers must consider the impact of ASC 606 on common practices like sales promotions and loyalty programs. KPMG notes that recognizing revenue when control of goods transfers to the customer, as mandated by ASC 606, might differ from traditional revenue recognition practices in retail.

ASC 606 Documentation: Best Practices

Proper documentation is essential for complying with ASC 606 and ensuring the accuracy of your revenue recognition. When you can easily access and understand your contracts and accounting decisions, you're better equipped to demonstrate compliance and prevent issues during an audit. Here’s how to get it right:

Maintain Clear Contract Records

Keep your contracts organized and accessible. This includes having a centralized repository for all contracts, along with any amendments or modifications. A comprehensive contract review process is crucial for identifying all of your company’s performance obligations under ASC 606.

Document Performance Obligations

Clearly define and document each performance obligation within your contracts. This documentation helps demonstrate that you've properly identified and accounted for all revenue-generating activities. When you can point to a clear outline of each performance obligation, it's easier to prove you're recognizing revenue in line with ASC 606 guidelines.

Record Judgments and Estimates

ASC 606 often requires companies to make judgments and estimates, especially when determining the transaction price. Meticulously document these judgments and the methodology behind them. This documentation provides an audit trail and supports the reasoning behind your revenue recognition decisions.

Implement Robust Internal Controls

Having strong internal controls for revenue recognition is critical. This includes establishing clear policies and procedures for contract review, performance obligation identification, and revenue recognition. Robust internal controls not only help ensure compliance but also improve the overall reliability of your financial reporting.

How HubiFi Simplifies ASC 606 Compliance

Let's face it, staying on top of ASC 606 can feel like a full-time job. But what if you could automate the heavy lifting and get back to what matters most – running your business? That's where HubiFi comes in.

Automated Revenue Recognition Solutions

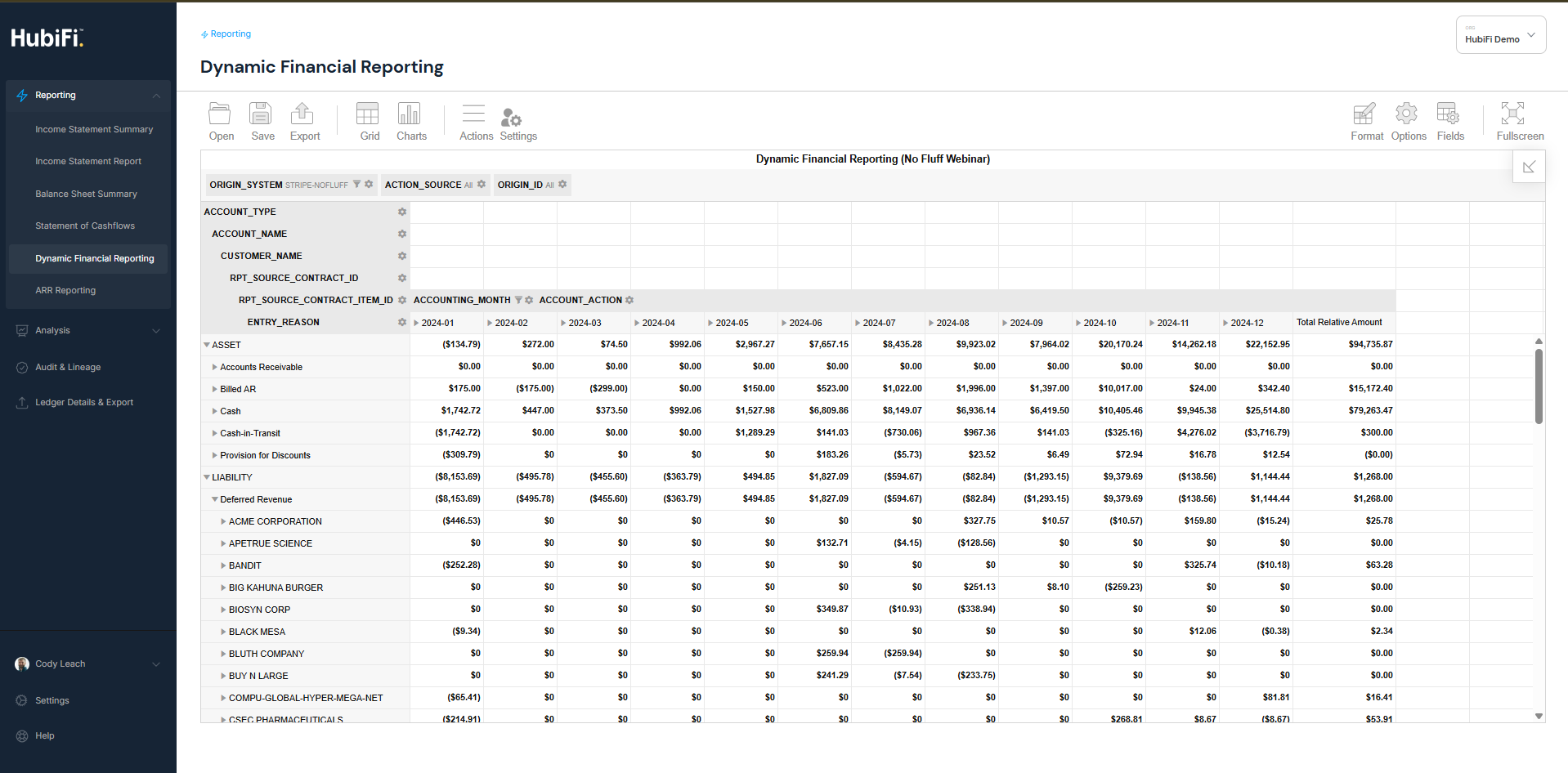

HubiFi takes the guesswork out of revenue recognition. Our platform automates the entire process, from identifying contracts and performance obligations to recognizing revenue in accordance with ASC 606. Think of it as having a dedicated accounting team working behind the scenes, ensuring you're always audit-ready. Stripe's ASC 606 guide highlights that automated solutions are key to streamlining accrual accounting and simplifying revenue recognition.

Real-Time Analytics and Reporting

Need a clear picture of your financial health? HubiFi delivers real-time analytics and reporting, giving you the insights you need to make informed decisions. No more waiting until the end of the month (or quarter!) to understand your financial position. This real-time visibility is crucial for businesses to understand their performance and make sound decisions.

Seamless Integration with Existing Systems

Don't worry, we play well with others. HubiFi seamlessly integrates with your existing accounting software, ERPs, and CRMs. This means no more manual data entry or wrestling with incompatible systems. Certinia's ASC 606 overview emphasizes that seamless integration, along with flexible data models and configurable templates, is a must-have when choosing a revenue recognition solution.

Ready to simplify ASC 606 compliance and take control of your financial reporting? Schedule a demo with HubiFi today.

Related Articles

Frequently Asked Questions

What happens if my business doesn't comply with ASC 606?

Failing to comply with ASC 606 can have serious consequences. Think potential financial restatements, a blow to your company's credibility with investors, and even legal ramifications. It's not worth the risk! Getting ahead of ASC 606 and ensuring your business is compliant protects your company's reputation and fosters trust with stakeholders.

How often do I need to review my company's revenue recognition policies?

Think of your revenue recognition policies as a living document, not something you create once and forget about. It's a good practice to review them at least annually or whenever there's a significant change in your business model, like introducing a new product line or changing your pricing structure. Regular reviews help ensure your policies are up-to-date and aligned with ASC 606.

Can I implement ASC 606 on my own, or do I need external help?

While some businesses might have the internal resources to tackle ASC 606 implementation, many find that partnering with experts, like the team at HubiFi, makes the process smoother and more efficient. Think about it: experts can provide tailored guidance, help you navigate complex scenarios, and offer valuable peace of mind.

What are some common red flags that my business might not be on track with ASC 606 compliance?

Keep an eye out for these red flags: frequent revenue adjustments, difficulty reconciling revenue with your contracts, and a lack of clear documentation to support your revenue recognition decisions. If these sound familiar, it's time to take a closer look at your processes and consider seeking expert guidance.

What are the key benefits of using a software solution like HubiFi for ASC 606 compliance?

Using a software solution like HubiFi can be a game-changer for ASC 606 compliance. Think about it: automation reduces the risk of manual errors, real-time analytics give you instant insights into your financial performance, and seamless integrations with your existing systems streamline your workflows. It's all about working smarter, not harder.